Who's Rich? Redux

Exclusive polling from Find Out Now

First, for any who were taken in, I should clarify that last week’s post - a review of A World of Our Own - was an April Fool. There is, sadly, no new Netflix series about the Amish in space.

A long, long time ago,1 back when this substack had about 100 subscribers, I ran a reader survey asking people who was rich. The answers were interesting, as far as they went - but far too small in number to be meaningful.

By good fortune, Find Out Now, a member of the British Polling Council, offered me a free nationally representative poll, which I’m tremendously grateful for and which I’ve used to rerun it.2 So here we have the results of a nationally representative survey of 1050 representative adults,3 telling us who, in different scenarios is rich, what proportion of adults are rich, how much you need to earn to be rich - and even whether they consider themselves to be rich.

So buckle in and enjoy the ride.

Scenarios - Fictional and Real

Many people don’t have a strong view on what it means to earn £100,000 a year, or how much difference it makes to own your own house. One useful4 was to overcome this is to ask people about well-known fiction families - and ask whether they are rich or poor.5

We can see three families classed by more than half of people as rich. Kevin’s family from Home Alone was overwhelmingly considered rich - unsurprisingly as we see their massive house, many belongings and the family flying First Class to Paris. Most people also thought the Browns from Paddington and the Bennetts from Pride and Prejudice were rich - though a sizeable number didn’t, and with 9% - well above Lizardman’s Constant - thinking the Bennett’s were actually poor.6

From the other end, Charlie Bucket is clearly poor, with a surprising number also considering Matilda Wormwood’s family and the March family poor.7 I’d have personally put the Wormwords in the ‘neither rich nor poor’ category, along with the Simpsons, Fawltys, and Cuthberts. The Dursleys are another tricky one. On the one hand, I suspect Rowling meant to portray them as an ‘ordinary’ family - yet Dudley goes to private school and gets 37 presents on his birthday. I think you could argue the toss either way.8

Now on to real scenarios. Just as with the fictional families above, when we judge whether someone is rich or poor we take a lot of things into account - their earnings, their house, their family circumstances and more. The Office for National Statistics evenhas a calculation for this, called Equivalised Net Disposable Income which takes into account direct taxation, benefits and household composition. In summary, the first adult counts for 0.67, the next for 0.33 and children for 0.2 - meaning a family of four needs almost twice as much net income as a single person.9

Most people don’t do maths in their head10 when assessing this, though, and go more by gut instinct. We asked people about various ‘standard’ scenarios of income and family size - as well as some more unusual ones.

We can see a few things here. Firstly, that family matters a lot. 87% of people think a single person earning £125k a year is rich - but that drops to just 57% if they have two children. About the same proportion - a third - think that a family with three children and a household income of £100k a year is rich as they do a single person earning £50k.11

We also see that people with masses of cash in the banks - whether from an inheritance or a trust fund - are considered rich, even if they’re not currently earning a lot. The biggest divide comes when that wealth is in the form of a primary home: opinion splits on the elderly widow in a very valuable house, with approximately a quarter considering her both rich and poor, with the remaining half saying neither.

What does it take to be rich?

Here’s a basic question. Forget about the numbers, what proportion of people do you consider rich? Is it the top 1%? Top 10%? Top third? Or what? A great advantage to this question is that it doesn’t rely on people carrying income distributions around in their heads to answer intelligently.12

There’s a considerable divide here, but the modal answer is 5% and the median answer is 10% - together, almost 6 in 10 respondents chose one of these two answers. To put this into perspective, to be in the top 10% of earners you need to be earning £60,000 a year; the top 5% just under £85,000 a year (though household income is likely to be higher - most households have two earners). To look at it another way, the top 5 - 10% is broadly equivalent to the proportion of people who can afford private school.13

When we split it by gender, we see that men see the ‘rich’ as being slightly more exclusive than women, with almost half saying it’s the top 1% or 5%, and three quarters the top 10% or fewer.14

But let’s try to put some numbers on it. Obviously - and as we’ve seen - being rich is about more than income. But we asked people to think about how much, thinking of income only, they had to earn to be rich:

There’s considerable variety here - but both the median and (just!) the modal figure was £100,000 a year. Almost half went for £75k or £100k, which seems pretty reasonable to me - but then, I would say that, as I’d have plumped for £100k as the cut-off myself.15

Fascinatingly, the median didn’t shift that much by household income. For those with a household income of under £10,000 a year, the median to be rich was £75k; then, for the 11 earnings brackets between £10,000 a year and £80,000 a year, the median to be rich was steady at £100k - before moving up to £150k a year for those earning between £80k - £100k and £100k - £120k, and then, finally, those with a household income of over £120k a year had a median to be rich of £200k a year.

Nobody16 thinks they’re rich!

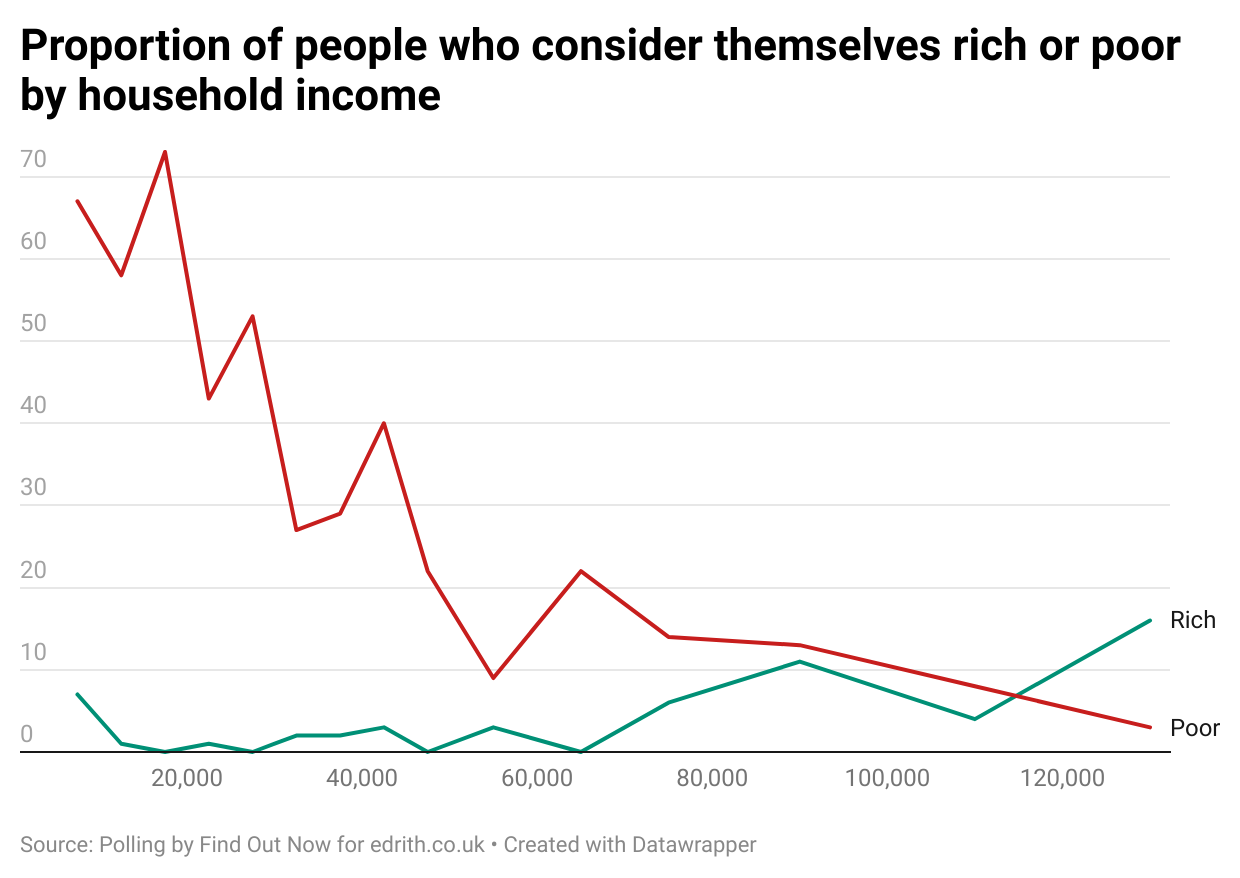

The number of people in each income bracket is pretty small - n varies between 24 and 8317 - so we get a pretty bumpy line, but we can see that you have to get up to the £80,000 - £100,000 bracket before we get even 10% of people saying they are rich - and even in the £120,000+ bracket, only 16% of people think they are. By contrast, for household incomes below £30,000 we typically have half or more of people thinking they are poor - and the lines don’t cross until above £100,000.

Beyond Income

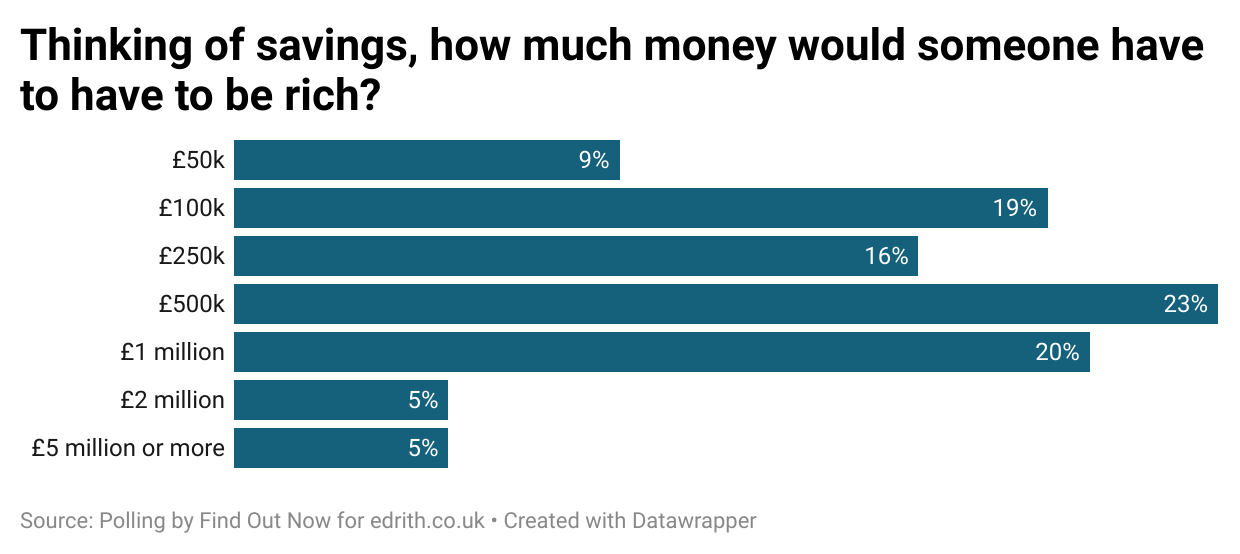

We all know being rich isn’t just about income. So we asked people to think about how much in savings would make someone rich?

The answer is that we don’t really have any consensus, but it’s probably between £100k and £1 million.

And how about what should be included when considering if someone is rich?18

Almost everyone thinks income should be included. Most people agree that savings should, and almost 9 in 10 agree that businesses and land should be counted.19

Where it gets interesting is in the value of a pension or a person’s primary home. Just over half think this should be considered - but around a third don’t. And indeed, we see this reflected in national political debates, where the high value of public sector pensions isn’t valued by most at its real cost, and why reforming council tax - with the potential income on income-poor pensioners living in very valuable homes - is politically so difficult.

So where does that leave us?

Unsurprisingly, there’s a great deal of variation in what people consider makes someone rich - as well as what we should take into account when deciding it. But there was surprising consensus, too. If you’re a politician, or commentator, or anyone else who needs to use the term in a way that’s going to resonate with most people, a good rule of thumb is that it’s the top 5 to 10%, and people earning £75k to £100k - or perhaps a bit more if they have a family. And to be very careful if you want to start including pensions and primary homes in that!

Also known as May 2023.

Yes, I’m aware I said a week ago I’d been offered something which was entirely false, but that was on April Fool’s Day and today, as Aragorn might say, is not that day.

Find Out Now surveyed 1050 GB adults on the 31st March 2025 to produce a sample nationally representative by age, gender and region. Find Out Now is a member of the British Polling Council and abides by its rules.

Not to mention fun.

In all graphs, ‘don’t knows’ have been excluded from the totals.

This is clearly indefensible. The Bennetts are part of the gentry, itself a small upper slice of society, and are wealthy within this - compared to, for example, Mr Collins, or (to choose a different author) CS Forester's Hornblower. No-one in the family works, except for administering their estate, and they have an income of £2000 a year, roughtly 180 times that of an average labourer. They go to balls and Jane is considered a natural match for Mr Bingley who is 'in possession of a good fortune'. Yes, the estate is entailed, meaning that the daughters and Mrs Bennet may have nothing if Mr Bennet dies - but they are rich now, even if Mr Darcy is richer.

Putting money equivalents in today's terms is always tricky, but given a labourer then earned £12 a year and a bailiff £20 a year, multiplying by a couple of thousand seems a decent rough and ready estimate. Doing this, the Bennets have an equivalent income of £4 million a year, and Darcy £20 million a year - yes, Darcy is richer, but both are very rich.

Genteel poverty is an odd one. Yes, they’re poor by the standards of their class, but this is the Industrial Revolution and I don’t see any of them working in factories.

I’m more perplexed by the 15% who think they’re poor. Do they think Harry has to sleep in the cupboard under the stairs because there’s no other space available?

The Institute for Fiscal Studies has a brilliant calculator which lets you try out different scenarios and see how this compares to the rest of the population.

Really?

Interestingly, the two scenarios aren’t that far off if you run them through the ONS’s formula.

Or worse, to require both the income distributions and the doing maths in their heads, which is entirely unreasonable, except for the highly virtuous maths lecturers.

About 6% of children are in private school - but of course some who could afford it choose not to, and others below the the 6% do so via bursaries, or remortgaging their house, or other means. So it’s an imperfect measure, but not a bad one, nonetheless.

This could perhaps be explained by men tending to earn more than women - or by men, on average, being more competitive.

Isn’t it wonderful when polls confirm our own prejudices?

Very few people.

Quite a high proportion of people, understandable, chose not to answer this question.

In typical wonkish fashion I think we should include all of these things.

If you’re in the 10% who think businesses and land don’t count, Elon Musk would like to talk to you about how even though he owns SpaceX and Tesla, he’s not really rich at all and shouldn’t pay any tax. The Duke of Westminster might like a word, too.

I think there's a significant difference between rich (relatively well off) and rich (could live to a good standard off their capital).

But I would say that as I have a high income but also still feel worried about money / what happens if I lose my job, have no significant capital other than my primary home (still under significant mortgage) etc.

With businesses and land, I think the position of the threshold depends on whether it's your only source of income and/or home, or you own it in addition to having a normal income.

Someone with an average job, house, and mortgage is rich if they additionally have, let's say, £500k of savings. So if instead they own a £500k business or £500k of land in addition to their average job/house/mortgage (maybe they inherited it), that feels equivalent, and they are rich.

But if someone owns a £500k working family farm, and it's their home and their only (probably below average) income, and the home and income for several of their family members, then they're not rich. If they sold the farm, they'd have no home, no income, and a pile of cash that they'd burn through in a decade or less (depending on how many people in the family and how frugal they are).

Whereas if someone owns a £500m business, they're rich, even if it is their only source of income, because they could sell it for enough liquid assets that they could live comfortably off the interest/dividends indefinitely and still have generational wealth.

That's my instinct, anyway; I don't know how well it would stand up to rigorous formulation.