Talking About Tax

Plus: The 2024 Prediction Contest closes this weekend

A major dispute in tax discourse currently is how to talk about specific changes in tax rates, such as the recent cut in National Insurance last November. Is tax rising, or is it falling?

This is obviously a politically charged question. If you’re the Conservative Party, you want to be able to say you’re cutting taxes, and that this is a Good Thing. And if you’re the Labour Party, you - somewhat surreally - want to be able to say that the Conservative Party is putting up taxes and that this is a Bad Thing1.

So which is true?

The First Lens: Tax is Rising

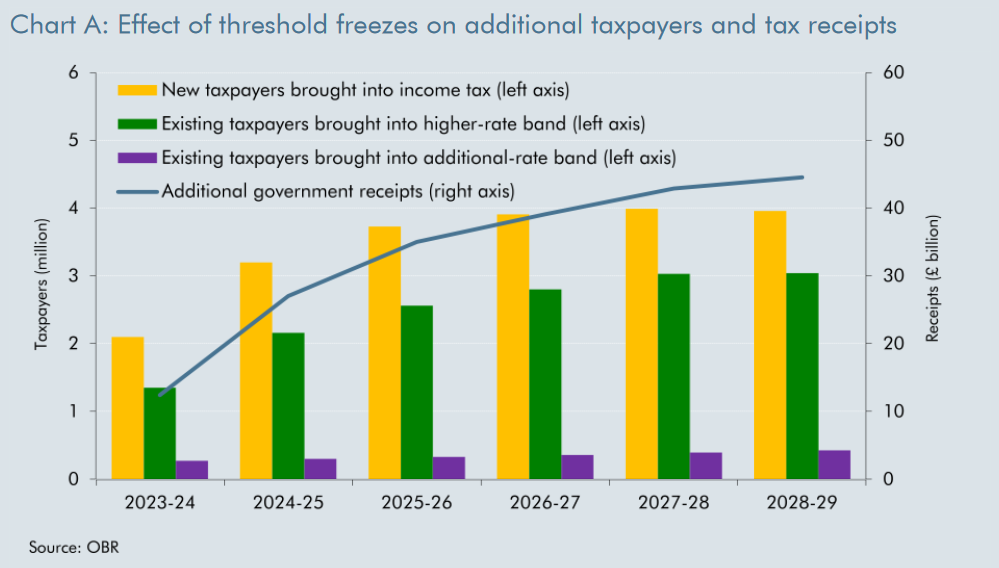

This is the lens favoured by most economic commentators and, at a societal level, is undoubtedly true. The freezing of the thresholds for income tax and National Insurance since spring 2021 has - when combined with inflation - meant that, on average, individuals are paying a greater share of their income in tax. This is because, on average, wages have increased over that period - quite rapidly last year - but the tax thresholds are staying the same.

A salary of £35,000 today would have about the same purchasing power, in real terms, as a salary of £30,000 in 2021. And given that the income tax threshold has stayed the same, we can see that the person today is paying a greater share of their income in tax. A corrolary of this is that the Government is taking a greater share of GDP in personal taxation (and, indeed, in taxation overall).

So if you’re looking for the answer to the question ‘Has tax gone up since the last general election’ then the answer (sadly) is yes; similarly, the answer to the questions ‘Is the person on median wage paying more income tax’ or ‘is the Government taking more tax, in real terms, via income tax and National Insurance’ is also, in both cases, yes. And the answer to, ‘Have the Conservatives, overall, cut tax’ is, sadly, no.

So, very often, this first lens is the right one. But it is not the only one - and a particular bugbear of mine is too many commentators who should know better acting as if it is the only right way of thinking about this.

The Second Lens: Tax is Falling

Margaret Thatcher famously said there is no such thing as society2. And while one can debate that point, most people, unless they are economists or journalists or politicians, don’t think so much about the overall tax burden of the nation, but upon whether they, personally, are paying more or less tax.

And for many of those people, last autumn’s cut to National Insurance will mean that tax is falling.

Unless you work in the public sector, you’re unlikely to get a guaranteed pay rise every year3. Your salary may stay the same for two or three years in a row. During that time, inflation will be making you slightly poorer - but that’s inflation, not taxation, or ‘fiscal drag’.

If then, during that time, a government cuts income tax or National Insurance, you will indeed be paying less tax - and be richer than you would otherwise have been. For you, tax is indeed falling.

(As an aside, it is also worth observing that the threshold freezes had been announced in 2021, but the National Insurance cut was announced last November - they were new. In a very real sense, taxes were lower this January than they were going to be in October. To take it right down to the personal level, I - and everyone else who pays National Insurance - will get a larger pay check at the end of this month than they would have done had the NI cut not taken place).

Now, over a five year period, maybe people will get a pay rise, or move jobs for a higher salary, or otherwise get caught by the frozen thresholds. In the end, inflation catches up with us all. It is certainly true that, for any given individual, the odds are they will be paying more tax, not less as a result of the last three years’ tax policy. But some will be paying less.

I think the reason some people object to this lens so much is not just because they prioritise the societal lens - but because they feel that acknowledging it somehow gives credence to the idea that this specific cut to NI might help the Conservatives’ electoral prospects. “But, but, but!” they protest. “The £50 a month this will give is dwarfed by the impact of inflation, by the cost of energy, by increasing mortgage payments. Even without fiscal drag, people don’t feel better off.” And all this absolutely true. Real household incomes have been clobbered over the last few years4.

Last November’s tax cuts will not change that. And overall, tax is rising. But it remains true that, for some people, the cut to National Insurance means that they are, indeed, paying less tax.

The Third Lens: Tax is Changing

If push came to shove, I’d go with the first lens as being the most important - though remembering to keep half an eye on individual differences. Overall, the level of personal taxation is increasing. But what what is almost equally interesting is that tax is changing.

Regardless of which lens you use, the combination of freezing the thresholds and cutting National Insurance means that the balance between income tax and National Insurance has shifted, with more revenue now being raised through the former and less through the latter5. And that, in my view, is a thoroughly good thing.

National Insurance, despite the public perception, is not hypothecated. It doesn’t pay for the NHS, or pensions, or anything else - it goes into the same big pot with all the other taxes, and then the Government pays for stuff. It’s an income tax by another name - with one important difference, that it is only payed by those in work, not by those with other income, such as from a pension.

Taxing earned income at a higher rate than unearned income doesn’t make a great deal of sense. At the level of individual fairness, why should two people with the same income pay very different levels of tax?6 And at the whole economy level, taxing earned income - ‘taxing jobs’, as it’s sometimes called - creates a ‘deadweight loss’ - a weakened incentive to work, or to take on a higher paid (but perhaps higher stress, or longer hours) role - which harms the economy as a whole. For any given level of personal taxation, I’d rather more was taken via income tax than NI.

In an ideal world, I’d like to merge National Insurance in to income tax - and simultaneously reduce the rate of the latter, to make the change fiscally neutral7. But whether or not this happens, this shift is a positive move, one that makes the tax system both fairer and less economically distorting.

And a final reminder: take part in the 2024 Prediction Contest! And share it, too, of course.

The fact that we are through the looking glass on this subject demonstrates just how strongly that the Realignment was, and is, a real phenomenon. The only mistaken part was that only the Conservatives could benefit from this: Boris did indeed surf that wave in 2019, but now it is Labour who are doing so more effectively.

To give the full quote, she said, “I think we have gone through a period when too many children and people have been given to understand ‘I have a problem, it is the Government’s job to cope with it!’ or ‘I have a problem, I will go and get a grant to cope with it!’ ‘I am homeless, the Government must house me!’ and so they are casting their problems on society and who is society? There is no such thing! There are individual men and women and there are families and no government can do anything except through people and people look to themselves first.

It is our duty to look after ourselves and then also to help look after our neighbour and life is a reciprocal business and people have got the entitlements too much in mind without the obligations, because there is no such thing as an entitlement unless someone has first met an obligation and it is, I think, one of the tragedies in which many of the benefits we give, which were meant to reassure people that if they were sick or ill there was a safety net and there was help, that many of the benefits which were meant to help people who were unfortunate—“It is all right. We joined together and we have these insurance schemes to look after it”.

That was the objective, but somehow there are some people who have been manipulating the system and so some of those help and benefits that were meant to say to people: “All right, if you cannot get a job, you shall have a basic standard of living!” but when people come and say: “But what is the point of working? I can get as much on the dole!” You say: “Look! It is not from the dole. It is your neighbour who is supplying it and if you can earn your own living then really you have a duty to do it and you will feel very much better!””

Yes, not every public sector worker gets a guaranteed pay rise every year either.

Amongst other things, it turns out that you can’t shut down half of the economy for months on end, while borrowing extensively, and not pay a price for that. Lockdowns have undoubtedly made us poorer, both individually and as a nation; that may or may not have been a price worth paying.

Though overall more is being taken, as previously said.

There may be good reasons for this. For example, some countries tax people with children less, on the grounds that they have more dependents and therefore more expenses - and that having children is a good thing that the state wants to encourage. But this would not apply here: indeed, if anything, many pensioners would have less outgoings, as they may well have paid off their mortgage.

Ultimately, I’d like to reduce the rate considerably more, but this would require reducing public spending also, which is another post.