Who's Rich? Survey results

The results of the 'Are the Dursleys rich?' survey - a survey about who was rich, looking at a variety of fictional characters and case studies.

Thank you to everyone who took part in the survey a couple of weeks ago about who was rich, looking at a variety of fictional characters and case studies. The results are fascinating and we'll be looking at them here.

The most fascinating thing about the results was the lack of consensus in almost every area except the most extreme. People didn't agree about who was rich, whether we were talking about fictional characters, specific scenarios or percentage of the population - which is at least consistent. We'll be looking here at the results, some of the discussions I've had with people about them and my own thoughts.

And before we continue, if you enjoyed doing this survey, you can help by sharing what I write (I rely on word of mouth for my audience). You can also ensure you never miss a post, by entering your email address into the subscription form below.

To start with the basics, 84 people took the survey. This is an unrepresentative, not demographically weighted sample, so you should be cautious about drawing any broader conclusions from it. I also suspect that the people taking the survey are probably wealthier than the UK average, which should also be borne in mind. Nevertheless, the results are interesting.

Almost everyone answered every question and all percentages are given as a proportion of those who replied to that question, after taking out any 'don't knows' or similar answers.

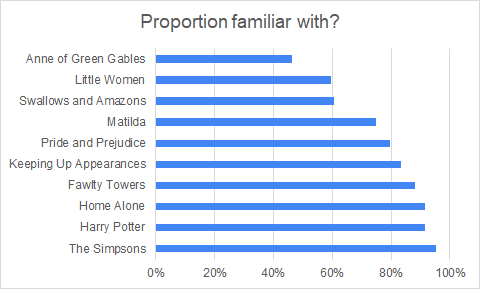

Fictional characters

We have near consensus at both ends: only 3% of people think the Simpsons are rich, while 94% think Kevin's family from whome alone are. I agree with both of these conclusions.

I was surprised by the fact that almost 4 in 5 people think the Dursleys aren't rich, as I'd picked them as an example where it feels one can argue it either way. Certainly I don't think Rowling meant to portray them as rich - the book opens talking about how ordinary they are - but on the other hand, as several people have strongly expounded to me, Dudley goes to private school and gets 37 birthday presents. With most people thinking the Dursleys aren't rich, it's no surprise that the Wormwords and Hyacinth Bucket come below them, as these are also suburban middle-class families, in both cases similar to or less wealthy than the Dursleys.

The fact that a quarter of people said the Bennets are not rich also surprised me, as I'd included them as a 'clearly rich' example. Looked at objectively, I don't see you can say they are not rich: they're part of the gentry, itself a small upper slice of society, and are wealthy within this - compared to, for example, Mr Collins, or (to choose a different author) CS Forester's Hornblower. No-one works, except for administering their estate, and they have an income of £2000 a year, roughtly 180 times that of an average labourer. They go to balls and things and Jane is considered a natural match for Mr Bingley who is 'in possession of a good fortune'. The tension comes from the fact that the estate is entailed, meaning that the daughters and Mrs Bennet may have nothing if Mr Bennet dies - but they are rich now.

After speaking to people, I have a number of theories about this. The first is that people have a more intuitive grasp of what wealth means today than 200 years ago. They see the family in Home Alone flying First Class to Paris and they know that means they're rich - that intuition isn't there for the Bennets. The framing of the story with the gentry the only people in society may reduce people's natural comparisons (similar to the way we accept the March families 'poverty'). We may also pick up cues from the source itself. In Home Alone, the Wet Bandits talk about how rich the house is; ergo, they are rich. In Pride and Prejudice we are instead repeatedly told how rich Mr Darcy is. Now, putting money equivalents in today's terms is always tricky, but given a labourer earned £12 a year and a bailiff £20 a year, multiplying by a thousand seems a decent rough and ready estimate. Doing this, the Bennets have an equivalent income of £2 million a year, and Darcy £10 million - yes, one is richer but both are very rich.

The last two to mention are the March family and the Fawltys. I am sceptical of the March Family's constant claim to poverty - this is the middle of the Industrial Revolution, and I see none of them working in factories. In the end though, I also, alongside 80% of respondents ultimately conclude that, regardless of whether they are poor, they are not rich. The Fawltys is interesting because so much depends on the state of their business - is the hotel mortgaged to the hilt, or owned outright? It doesn't appear to be thriving. I've known several people in that situation (running a small hotel, or a pub), and have rarely thought them rich, so I was with the majority who thought the Fawltys were not rich - but can understand the 26% who thought they were.

A final unanticipated bonus of this set of questions was the ability to see which books and films are best known. The Simpsons' hegemony ultimately triumphed, beating even Harry Potter - with an unexpectedly strong showing for Home Alone. Congratulations to the 16 respondents who are familiar with all of the examples given - you have impeccable taste in film and literature.

Income

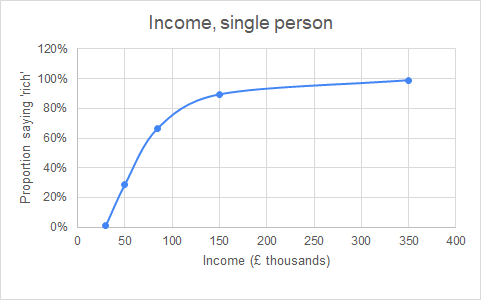

In this section I asked a number of questions about income. To give some contest to the specific numbers polled (which I deliberately didn't give in the survey), £30,000 is close to the full-time median income(1) and also - from this September - the starting salary for a new teacher, £50,000 is the point where someone becomes a higher rate tax payer, £85,000 is a little above the threshold where Jeremy Corbyn proposed a new, 45%, rate of income tax in his 2019 manifesto and is roughly the top 5% of earners(2), £150,000 is where the top rate of tax kicks in, and is close to the top 1% of earners, and £350,000 is just a very high number.

We started by looking simply at single earners, in many ways the simplest.

There is very strong consensus that a single person earning £30,000 a year is not rich, which someone earning £350,000 a year is - and quite strong that someone earnign £150,000 a year is rich.

There is much less consensus when it comes to earnings between £50,000 and £100,000 - with most people putting the transition somewhere in that area, but disagreement as to where.

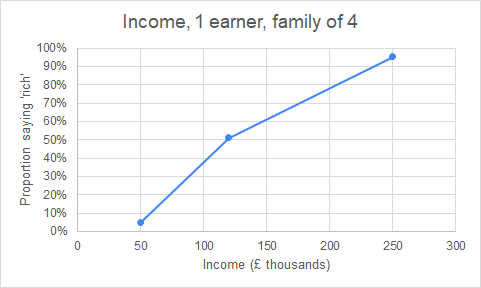

Now let's look at families.

We can see that the cross-over point here is at £120,000, if that same person is the sole earner of a family 4. That's about double what it was for a single person, which at first sight seems reasonable - but we'll explore that more below.

Now let's look at a family of four with two earners, each earning the same:

Again, we see a broad lack of consensus below each parent earning £100k, with the cross-over point being about £60k - £70k.

One complexity with assessing this is that, due to the tax system, a single earner earning £80,000 does not bring home the same amount of money as two earners earning £40,000. Due to the progressive tax system, the person earning £80,000 will bring home £55,500, but the two earners earning £40,000 will bring home £62,444(3). If they have children, the differences are even more stark - the single high earner will lose child benefit (worth just over £2,000 for two children), for a net discrepancy of almost £9,000 of after-tax income. Needless to say, this is quite a lot - and warps our judgement of where people sit on the relative scale.

That's just about net income. Clearly, a family of four needs more net income than a single person to achieve the same living standard. Fortunately, the Office for National Statistics has a calculation for this, called Equivalised Net Disposable Income which takes into account direct taxation, benefits and household composition. In summary, the first adult counts for 0.67, the next for 0.33 and children for 0.2 - meaning a family of four needs almost twice as much net income as a single person. The Institute for Fiscal Studies has a brilliant calculator which lets you try out different scenarios and see how this compares to the rest of the population.

The overall effect of this is that most of us - myself included - dramatically underestimate how well-off single people are. Fascinatingly, a single person earning £50,000 is in the top 10% for household income - yet only 29% of people here said they were rich. That's almost the same as the single earner of £120,000 (top 13%), who 51% said was rich.

We also are bad at judging at how much better two incomes are than one. A family of four with two earners of £66,000 (39% thought were rich) have a net income a full £20k higher than the same family with a single earner of £120k (who 51% thought were rich). The single earner would actually have to earn £150k to bring home the same net pay as the two earners on £66,000 - taxing by individual, rather than by household (as they do in France) really favours dual-earning households! It also messes up our intuitions, as £150,000 feels a lot more than £66,000.

Percentages and Savings

I asked about what proportion of the population were rich - and also how much money someone would need to have for them to be considered rich. Both answers showed a fairly broad bell-curve.

Just over half of respondents though that rich meant either the top 5% or top 10% - but there was a respectable number (almost 1 in 5 in each case) who went for top 1% or top 20%; it's clear there's no real consensus about this.

Similarly, most people thought that 'rich' meant somewhere between £500,000 and £1 million. Nearly everyone (including me) said they judged 'rich' by some combination of income and wealth in an approximate way.

On an individual level these numbers weren't always consistent: one set of three consecutive responses stands out as having put 1%, 5% and 10% for the first question, but all having answered £1m for the second. Similarly, answers on 'top X%' didn't always correlate with the answers to the scenario. That's fair enough - most people don't have a strong sense of exactly how much income puts someone where in the distribution scenario, especially given the tax complexities described above.

Overall though, these answers do seem broadly consistent with the answers to the income scenarios: most people putting 'rich' somewhere in the top 5% - 10%, but with a fairly broad range on either side.

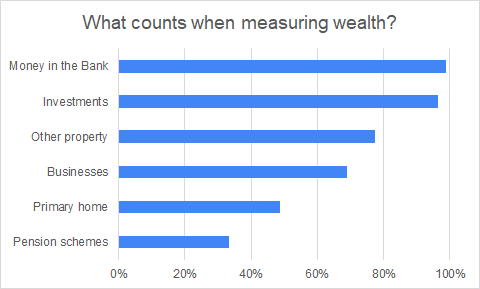

What counts towards being rich?

I asked a further set of questions aimed at finding out what sort of assets people felt contributed to someone being rich. First I asked about three scenarios:

a) A single person earning £50,000 a year, owning their own home with £250,000 of savings in the bank / ISAs.

b) An elderly widow living on the state pension only, owning their own home (no mortgage) which they have lived in for 60 years, and is worth £750,000.

c) A classroom teacher earning £35,000 a year, with a defined benefit final salary pension scheme valued at £500,000 (i.e. this would be the cost to purchase an equivalently good annuity).

Fascinatingly, 76% thought (a) was rich; 20% thought (b) was rich; and only 2% thought (c) was rich.

Earlier in the survey, only 29% of respondents thought a single person earning £50,000 (wealth unspecified) was rich, meaning the knowledge of the £250,000 of savings flipped almost half of respondents from thinking 'not rich' to 'rich'. The widow, notably, has a lot less income, but the ability to realise a lot of money by down-sizing does not count for much with people - and the pension scheme doesn't carry any weight at all.

I asked a more straightforward question about this, with the results largely matching:

I will ignore the respondents who said that money in the bank or investments such as shares and ISAs don't count when measuring wealth, as they are below Lizardman's Constant. Beyond this, the results broadly track the liquidity of the asset in question, which is pleasing in that it makes a degree of sense.

Only about a third of people thought pension schemes counted towards wealth. I think this is broadly defensible. Firstly, while it is an asset, you can't get money out of it now. If someone was due to get £20m in twenty years, but now lived on minimum wage, I think it would be justifiable for them to say, 'I'll be rich in the future, but I'm not rich now'. Secondly, for almost everyone(4), their pension will be lower than their current income - so if they're not already rich, it's unlikely they'll think considering the pension will make them so. Not having a pension definitely impacts how well-off you'll be in later life though, so unfortunately this just contributes to how much people undervalue pensions.

I have less sympathy for the roughly half of people who don't count the primary home. If you spend money on a house, that's still spending it, just as much as if you spent it on holidays or luxury goods. Similarly, if you are living in a very expensive house, you could choose to downsize and get the money. You might prefer not to - but you could. The fact that we have a housing crisis in this country, with houses far too pricey, doesn't take away from this.

I also agree with the majority that other property and businesses should be included in the calculation. Of course, just because you have a business doesn't mean you're rich - it could be mortgaged to the hilt and doing very badly - but if it is worth something, that counts towards your assets. And obviously at the top end, Mark Zuckerberg's ownership of Facebook is clearly a big reason why he's rich.

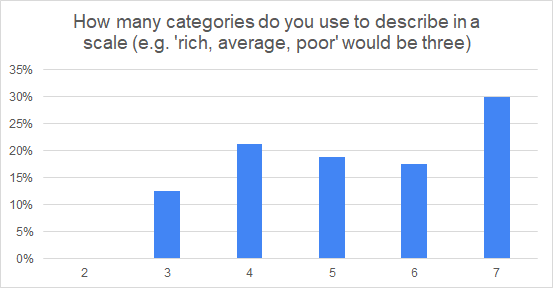

On categorisation, there was a wide variety of answers with a slight bias to the high end: slightly surprisingly, most people said they used a seven-point scale (I use 6 myself).

And finally, I asked people if they thought they were rich, and if they thought the household they grew up in was rich.

20% of people thought they'd grown up in a rich household, with 29% saying they were now rich, so yay for upwards mobility. More interestingly, I'd wanted to see if there was any correlation with the other answers.

What I found was that, generally speaking, people who said they were rich had a lower threshold for defining rich. This wasn't at all strong or consistent, but it was there. For example, when looking at the 'What proportion of people overall are rich', those who said they themselves were rich constituted:

0% of those who answered 'top 0.1%'.

19% of those who answered 'top 1%'.

32% of those who answered 'top 5%'.

29% of those who answered 'top 10%'.

44% of those who answered 'top 20%'.

100% of the one person who answered 'top 50%'.

Similar patterns were found in other questions.

Or, to put it another way, the best way to feel you're rich is to lower what you think of as rich!

If you found these results interesting, you can help by sharing this post (I rely on word of mouth for my audience). You can also ensure you never miss a post, by entering your email address into the subscription form below.

(1) £35,000 would actually be slightly closer to this.

(2) He proposed £80,000, but I added a bit due to earnings growth since then.

(3) All calculations in this section are taken from here and here.

(4) Except, for example, an investment banker who becomes a vicar.